Crypto tokens are digital money that exist on a blockchain. Players use these tokens to buy things and save money. As you may know, crypto tokens are digital money used in different online systems. Crypto tokens work in a system that each user can trade and use.

Popular in use within the game sphere, the tokens are also useful in the financial field. You can use them for collecting, trading, and investing. Now, big companies are adopting the use of crypto tokens. These crypto tokens are popular in online games and finance.

In This Blog

What are crypto tokens?

Crypto tokens are digital money created on a blockchain technology. You can use crypto tokens for different purposes. Like buying online gaming tokens and making payments in online systems. As you know, you cannot use paper money for making online payments.

Players can trade and send these tokens without needing a bank or company. This process makes transactions safe and easy. Each token belongs to a specific blockchain, which gives it special uses.

How to Buy, Store, and Transfer Crypto Tokens

Buying digital tokens is simple. Some of the best exchanges, like Binance, Coinbase, or Kraken. You can use these platforms to buy, sell, and trade. It should ask for an email and a strong password to create an account. Some exchanges ask for identity verification to keep transactions safe.

After signing up for an account, link a bank account, credit card, or digital wallet to add money. Search for the token you want to buy and enter the amount. Always check prices before making a purchase.

Storing tokens is very important. Exchanges offer crypto wallets. But hardware wallets like Ledger or Trezor provide extra security. Exchange wallets keep tokens offline, protecting them from hackers.

To send tokens, enter the receiver’s wallet address and choose the amount. Always double-check the address because transactions cannot be reverse by exchanges. Some wallets charge a small fee for transfers.

Users are able to buy tokens and store them to use for trading, crypto gaming, or online purchasing. Learning how to protect them and keep them safe prevents that risk and saves the investment.

Key Features of Crypto Tokens

Crypto tokens are easy to use. In crypto, players do not need any brokers. You only need the internet to buy, sell, and trade. It is easy to use and simple to earn.

Crypto tokens allow players to join the digital economy. And give users a simple way to invest, play games, and use online services.

1. Different Uses of Crypto Tokens

Crypto tokens have many uses. They can work as digital money, show ownership of items, or give access to special services. Players use these tokens in different ways. Like buying items in games or making safe online payments.

2. Safe and Direct Transactions

Crypto tokens use blockchain to make transactions clear and safe. Each transaction is available on the blockchain, so no one can change or hide it. Smart contracts handle transactions on their own. You do not need any broker or bank. So, buying and selling are fast and safe.

3. Global Accessibility

Crypto tokens make it easy for anyone with internet access to join the digital economy. These tokens allow users to take part in online financial systems. This service is available 24/7 everywhere you need.

4. Security Features

Blockchain security supports digital tokens. To keep them safe from fraud and hacking. Every transaction is under blockchain to make it hard for anyone to change or steal data. You can store their tokens in special wallets.

5. New Ways to Buy and Sell

Non-fungible tokens (NFTs) help to buy and sell digital items. Each of the NFTs could be one-of-one, and players cannot duplicate them. These tokens give players real ownership of virtual items, making online markets grow.

Applications of Digital Tokens

Crypto tokens do more than act as digital money. In DeFi, digital tokens allow users to loan and trade without using a bank. This makes it easier for anyone to access financial services. NFTs are another big use of digital tokens. By using them, you prove ownership of digital art, music, and collectibles.

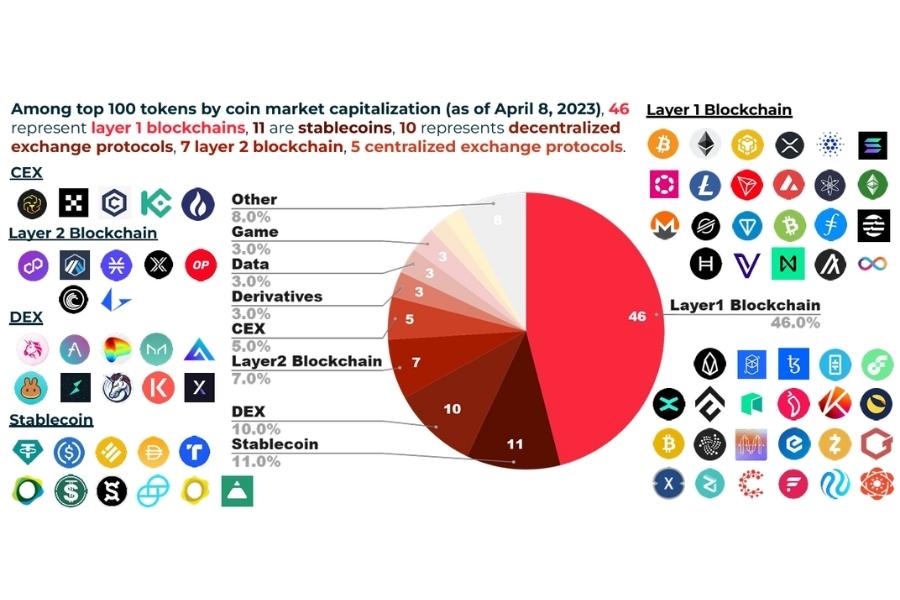

Different Types of Tokens

Crypto tokens have different uses in the blockchain world. Each type helps in a unique way.

- Utility Tokens – These tokens give users access to online services, apps, or games.

- Security Tokens – These tokens show ownership of company shares or real estate.

- Stablecoins – These tokens hold a steady value by linking to real money, such as the U.S. dollar.

- Governance Tokens – Owners of these tokens can vote on decisions in a project or platform.

- NFTs (Non-Fungible Tokens) – These tokens prove ownership of game items and collectibles.

Each token type helps users trade, invest, and take part in digital finance.

The Importance of Tokens in Crypto Projects

Tokens are an important key part of crypto projects. Many platforms use tokens to power apps, games, and financial services.

Some tokens work like money, allowing users to make payments online. And all others give special access to services or allow users to vote on project changes. Tokens also help creators sell digital art, game items, and collectibles.

These tokens attract investors and give users a way to take part in online worlds. Tokens make digital finance, gaming, and other blockchain services possible.

Future of Crypto Tokens

Crypto tokens will shape the future of digital finance and technology. You can use tokens in banking, smart contracts, and secure transactions.

In the coming years, tokens may replace traditional payment systems. Governments and businesses are exploring ways to integrate them into daily life.

As blockchain technology advances, crypto tokens will become more secure and accepted everywhere. The future of tokens looks strong, with continuous growth and innovation.

Final Thought: Why Crypto Tokens Matter

Crypto tokens help users manage money and technology. And also help connect digital systems with real-world finance. Tokens make online transactions faster and safer.

The main part is learning first about tokens for anyone before investing. Then you can use them to buy digital items, vote on projects, or support new technology. Understanding how different tokens work helps users make better choices.

Tokens are not for investment. They are also becoming a big part of online markets and new technology. As they grow, they will continue to shape the future of money and digital services.

Final Tip: Always stay informed, manage risks wisely, and make calculated investment decisions to maximize your success in the world of crypto30x.io!

Disclaimer: Please note that CRYPTO30X.IO does not take responsibility for any losses from trades.